This is the first blog in a two-part series on ‘Bad Targets for Policy’. The second in the series will be on immigration.

We’ve seen a lot of focus on the ‘costing’ of policies in the parties’ manifestos for the forthcoming UK election. But we must remember that money is only a means of keeping account. Accounts are important but they are not reality. An account of debt is important, but it is not a physical reality. When a government has a debt in its own currency which only it (or its institutions) can issue, its obligations are important but not physically binding. They are not even legally binding, since the debt can be devalued virtually to zero by inflation. It follows that the real implications of government debt are not simply consequences of current government spending and taxation and the gap between them. Indeed these may be among the least important causes.

The real consequences of government debt result from the physical burden implied by the future obligation to transfer some control over a portion of real goods and services from the state to holders of the issued debt, either as interest or in repayment of capital. That debt in the nominal quantity of the national currency (the total amount in pounds or dollars say) is only a starting point. Inflation changes the relationship between that number and the obligation in real goods and services; the changing size of the national economy alters the ability to fulfill a fixed obligation.

The issue of debt is not a one sided transaction. In the same way that you can’t have an overdraft unless your bank is willing to let you have one, governments cannot borrow unless someone is willing to lend to them. So for the government to borrow requires someone to want to buy their bonds. Government bonds are usually in strong demand because they are very safe ways of holding wealth, being backed by the tax-raising powers of national governments. So safe are they considered that in many cases financial institutions are legally obliged to hold a significant quantity of government debt to back short-term financial liabilities such as bank deposits. The result is that the willingness to lend governments money remains high even when the interest paid on that debt (as is currently the case) is very low. Beyond this high baseline demand for government debt, demand may also be influenced by many factors that are beyond the issuing government’s control. These may include anticipated returns on other forms of investment such as corporate bonds, stocks, land and property, as well as uncertainty about world events. The desire to invest in government by purchasing its debt may in fact be so great that some will even pay for the privilege – in that inflation is higher than the interest rate offered over the term of the bond! When an economic entity turns down such an offer it acts against its own self-interest.

Moreover, when the UK private sector as a whole holds more money than it currently wishes to spend, it only has two options for its disposal. It can save with the UK government by purchasing its bonds or it can “invest” overseas by paying for the foreign goods, services or financial assets of foreign firms or governments. It seems preferable that the saving of UK residents becomes investment in the UK government rather than going elsewhere.

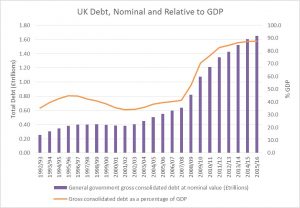

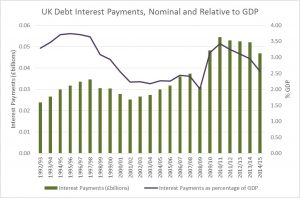

The presence of all these variables should lead to the conclusion that the actual quantity and trend of government debt is both extremely difficult to target and that targeting it is also quite likely to be counterproductive. The charts shown below indicate that the numerical size of the UK’s national debt is not straightforwardly correlated with the portion of our national output that the government must transfer to its debtors.

The attempts to cut UK government expenditure since 2010 have almost certainly led to lower economic activity, and have repeatedly failed even to achieve projected reductions in debt. The problems associated with large government debts usually have their roots in poor economic performance and efficiency in real terms rather than government profligacy in monetary terms. If government borrows when there is steady demand for its bonds, the costs of that borrowing are likely to be low, both because investors will demand moderate interest payments and because it suggests that there is little in the way of good domestic private sector opportunity for that investment. This latter condition implies that there will be a little in the way of ‘crowding out’ of private investment by the government’s own expenditure. Indeed it may well be, as was the case in Japan in the 1990s and is regarded by many economists to be the case now in the UK and the Eurozone, that human and material resources are being wasted because neither the private sector nor the public sector are making use of them. Even worse, lack of demand for labour, and for goods already in production may cause prices to fall – increasing the real burden of a fixed value of debt. By itself making productive use of otherwise idle resources, the government can make debt as a proportion of national output lower and thus actually easier to repay.

How can the government know that this process has run its course and that it should now borrow less? In a sense, a government with its own currency does not need to make this decision – the decision will be made for it. Once the government has made up any slack in productive capacity of the economy two things will happen automatically. In modern economies with independent central banks a third thing will also happen. Firstly, if the government is looking to purchase investment goods and services when these have become relatively scarce their prices and the profits of their producers will rise. All else equal this should make private investment more attractive, thus reducing the demand for government bonds and increasing the interest that the government must pay to have new bonds accepted. Secondly, without effective central bank intervention then the rising prices of investment goods will feed through to rising prices for consumption goods and for labour – there will be inflation. Inflation reduces government indebtedness and the real quantity of debt issued but this is likely to be offset by an increase in the interest now demanded for new debt.

Modern independent technocratic central banks are however programmed to respond to the potential for inflation by raising the rates of interest at which they provide reserves (the third consequence), which is likely to short-circuit the above process, making it even more difficult for government spending and debt to become a significant problem.

Even without these mechanisms there is no significant risk of a country with its own currency like the UK ‘going bankrupt’, because it can simply issue new money to repay all debts. This may make creditors unhappy, as their bonds lose value as a result of inflation, but their unhappiness will not be expressed in refusing future loans but in demanding higher interest rates. There will not be a sudden crash, but an incremental tightening which sensible policy can always reverse.

The reality is that if the right policy is enacted to maximize the efficiency of the economy in its use of resources to provide goods and services, government debt will take care of itself. Demand for debt will approximate its supply at a moderate cost that lies below the long run benefits derived from making full use of available resources. The output of the economy will be maintained or increased so that the real burden represented by fixed monetary debt remains steady or even shrinks.

Where it is clear that the private sector, for whatever reason, is failing to make efficient use of resources it is important that the government takes action to rectify this. It is this efficiency or lack of it that should be analysed in evaluating proposed policies rather than whether or not ‘the numbers add up’ as the journalists are wont to put it. Short-run increases in nominal monetary debt pale into insignificance compared to increases in the real burden of debt caused by reducing the economy’s capacity to meet the real obligations that debt represents.

2 replies on “Bad Targets for Policy 1: Government Debt”

I *almost* understand 🙂 getting there

– i an an interested random punter with zero economic education

Anything in particular that you find difficult to make sense of? Let me know and I’ll try and blog an explanation. Diarmid